Written by: Jonathan Hitter, CPA, MST, CGMMA In the November 2022 General Election, Voters approved an amendment to the Massachusetts Constitution, nicknamed the ‘Millionaire’s Tax.’ Starting in 2023, an additional 4% income tax will be placed on any ‘portion of…

Take Control of Your Legacy: Planning for Generational Wealth Transfer

The Silent Generation and Baby Boomers are incredibly fortunate generations—and so might be their heirs. Cerulli’s U.S. High-Net-Worth and Ultra-High-Net-Worth Markets 2021 report predicts these generations will transfer $72.6 trillion in assets to heirs and $11.9 trillion to charities through…

IRS Announces Retirement Plan Contribution Limits for 2023

Written by: Jonathan Hitter, CPA, MST, CGMA On October 21, 2022, the Internal Revenue Service (IRS) announced the updated contribution limits to retirement plans in Notice 2022-55. The new limits are valid beginning in tax year 2023. These limits are…

Which Type of Life Insurance is Right for You?

Written by: William Cooper, CPA Ask ten people whether you need life insurance, and you’ll likely get ten different answers. “Life insurance is a waste of money.” “Life insurance is only necessary for people with young children.” “Life insurance is…

Do You Know How to Navigate the New IRS Requirements for R&D Tax Credit Claims?

Written by: Jonathan Yorks, CPA While the new research and development tax credit requirements went into effect on January 10, 2022, which require more detailed proof that claims are valid, many businesses seeking the refund may face extra work when…

Funding a Buy/Sell Agreement with Life Insurance

Written by: David Cooper, CPA Any time multiple owners in a business are active in day-to-day operations, the business owners should have a buy/sell agreement. A buy/sell agreement is a binding contract between co-owners that controls when owners can sell…

The New 1099-Ks Are Coming: Are You Ready?

Written by: Jonathan Hitter, CPA, MST, CGMA A key provision of the American Rescue Plan Act passed in 2021 includes lowering the thresholds that trigger a Form 1099-K – Payment Card and Third-Party Network Transactions. This means businesses and individuals…

Understanding the Due Diligence Process When Selling a Business

Written by: William Cooper, CPA & Leah Belanger, CPA, MSA If you’re preparing to sell your business, you may have heard the term due diligence. But unless you’ve been through an M&A deal before, you might not know what the…

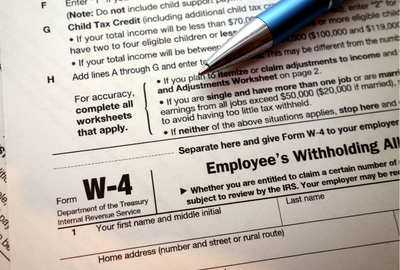

Under-withholding: Why You Owe So Much in Taxes

Written by: Michael Cooper, CPA Have you ever received a surprise income tax bill? You’re not alone. According to an analysis of IRS data, just over one-fifth (21%) of U.S. taxpayers owe the IRS money each year. And while owing…

WALTER SHUFFAIN RECOGNIZED AS A 2022 IPA TOP 200 FIRM

Inside Public Accounting (IPA) has named Walter Shuffain, P.C. (Walter Shuffain) a 2022 Top 200 Firm. This is the second year that the firm has broken into the Top 200 list. The IPA Top lists are the most comprehensive lists…