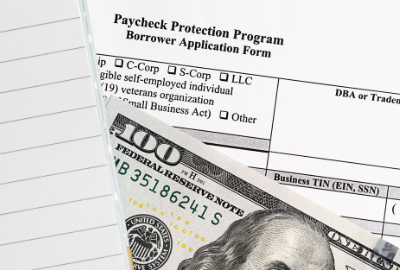

The IRS has released additional guidance in Notice 2021-20 on the Employee Retention Tax Credit (ERC) with clarifications on the retroactive changes for expanded eligibility applicable to 2020. Employers who received a Paycheck Protection Program (PPP) loan have been waiting on guidance…

New PPP calculation released for Form 1040, Schedule C filers

Form 1040, Schedule C taxpayers received an updated interim final rule (IFR) on the Paycheck Protection Program (PPP) from the Small Business Association (SBA). The IFR clarifies guidance released on Feb. 22 that made changes to how self-employed and sole proprietors could…

Smallest businesses get PPP updates, special filing period

The nation’s smallest businesses are getting revamped Paycheck Protection Program (PPP) rules and a special filing period announced in recent changes from the Biden-Harris administration. Small businesses with fewer than 20 employees make up 98% of the small businesses in…

Recordkeeping best practices are good for taxes

Have you ever tried to claim a new tax deduction, but in the process of compiling supporting documents, you found you were missing critical information and therefore missed out on the opportunity? Or, have you ever faced an IRS audit…

Business meals and entertainment expenses: What’s deductible?

The Tax Cuts & Jobs Act (TCJA) of 2017 made many significant changes for business tax deductions including the disallowing of the business deductions for most entertainment expenses. The IRS has since released final regulations for the treatment of meals and entertainment…

Massachusetts and PPP Loan Forgiveness

Massachusetts and PPP Loan Forgiveness Section 1106 of the CARES Act provides loan forgiveness to small businesses for certain loans made pursuant to the Paycheck Protection Program (“PPP”) under the Small Business Act. Under the Act, any amount of cancelled…

IRS announces 2021 standard mileage rates for business, charitable, medical, and moving purposes

The Internal Revenue Service recently issued the 2021 optional standard mileage rates. These rates, which adjust every year to account for inflation of fuel costs, vehicle cost and maintenance, and insurance rate increases, will once again affect the way a company reimburses their mobile…

Everything you need to know about the expanded ERTC

The employee retention tax credit (ERTC) is intended to provide liquidity to employers during the pandemic and was greatly expanded in the Consolidated Appropriations Act of 2021 thanks to Sections 206 and 207 of the Taxpayer Certainty and Disaster Relief Act portion, opening the doors…

Summary of the Employee Retention Tax Credit Provision of the CARES Act

Summary of the Employee Retention Tax Credit Provision of the CARES Act April 1, 2020 One of the many key provisions in the CARES Act is the Employee Retention Credit. This credit is geared towards employers subject to partial or…

Treasury issues interim final rules on updated PPP guidance

Three new interim final rules (IFRs) for the Paycheck Protection Program (PPP) have been released from the Small Business Administration (SBA) and Treasury in response to the changes and second round of funding enacted by the relief portion of the…